IREN Limited (formerly Iris Energy) has had some strong quarters before – but nothing like this. The company just delivered what might be the biggest milestone in its entire history: record revenue, record profit, and a clear signal that IREN is no longer “just a Bitcoin miner.” It’s becoming something much bigger.

Q1 FY2026 wasn’t simply a good quarter. It was the kind of moment that changes how investors look at a company. IREN’s mining business is performing at its peak, but what really caught the market’s attention is the company’s expanding footprint in AI compute. And when you dig into the details, it becomes obvious: IREN is quietly positioning itself to be a major player in the future of AI infrastructure.

Let’s break down what happened, why it matters, and where this transformation is heading.

Q1 Highlights – A Quarter That Turned Heads

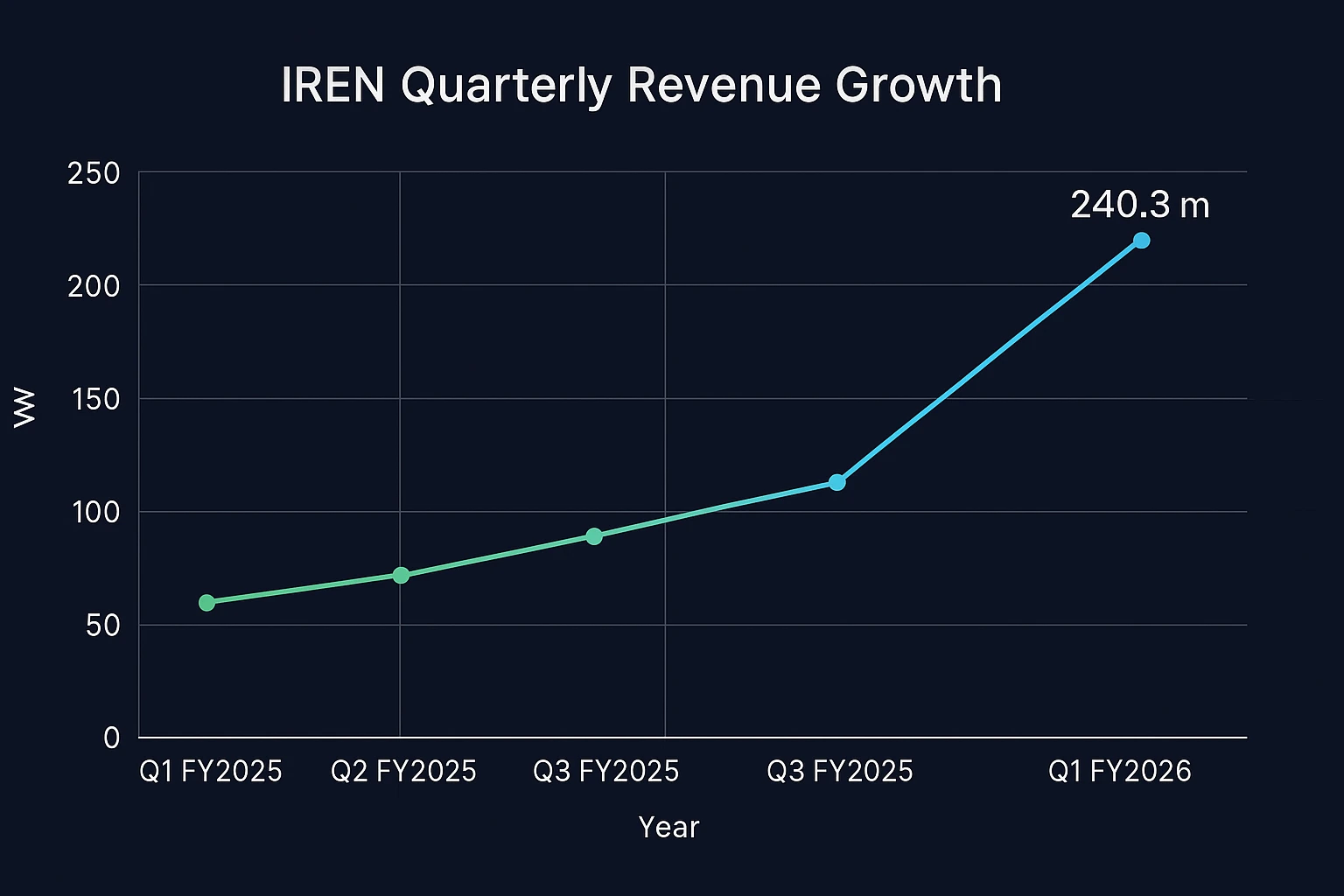

For the quarter ending September 30, 2025, IREN brought in $240.3 million in revenue. Last year, that number was only $52.8 million. That’s a 355% jump in just 12 months.

The company didn’t just boost sales – it flipped its entire bottom line. A year ago, IREN reported a $51.7 million loss in the same quarter. This year? A net profit of $384.6 million. It’s one of the sharpest financial turnarounds the mining sector has seen.

Adjusted EBITDA also skyrocketed from $2.5 million to $91.7 million, showing just how efficient the company has become.

Now, you could say Bitcoin’s 2025 rally played a role – and it absolutely did – but that doesn’t explain the full story. IREN achieved these results by scaling its mining fleet, lowering operational costs, and starting to generate its first wave of revenue from AI compute customers. Those three pillars together are what transformed Q1 into a record-setting moment.

Bitcoin Mining: Still the Engine, Still Crushing It

Even as IREN builds out its AI division, Bitcoin mining continues to be the company’s core business – and frankly, it is performing better than ever.

By the end of the quarter, IREN’s mining fleet hit 50 EH/s of power. That puts it among the largest Bitcoin mining operations on the planet. And the output reflects that scale. In August 2025, the company mined 668 BTC with an average of 44 EH/s. At current Bitcoin prices, that’s an enormous amount of monthly production.

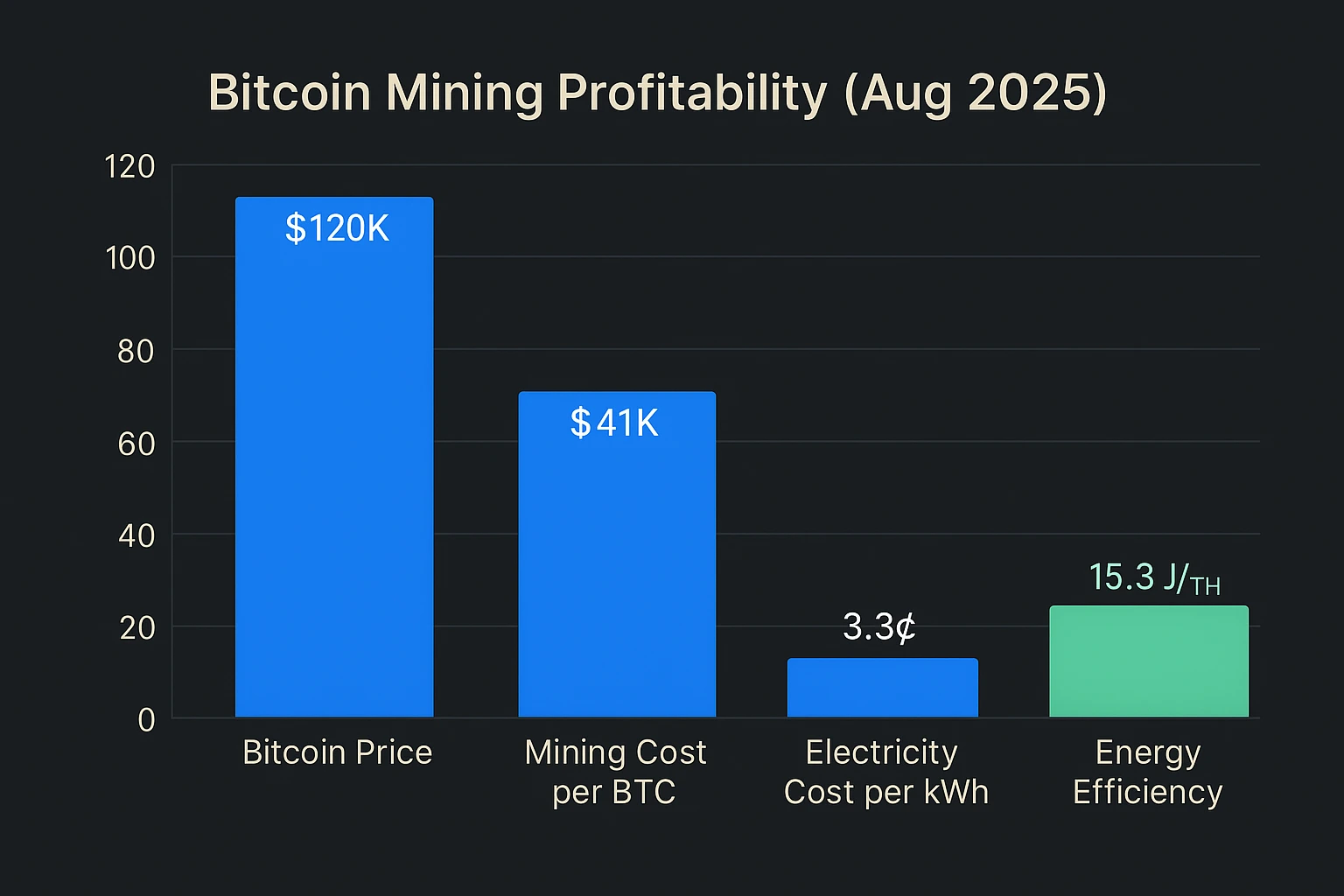

But the real magic behind IREN’s mining success isn’t just scale – it’s efficiency. The company upgraded its entire fleet to some of the most power-efficient machines available, bringing energy consumption down to about 15.3 joules per terahash (J/TH). Combined with electricity costs of roughly 3.3¢ per kWh, IREN mines one Bitcoin at an all-in cost of around $41,000.

When Bitcoin is trading between $90,000 and $120,000, that cost structure gives IREN one of the strongest mining margins in the industry.

The Big Shift: IREN Steps Into the AI Compute Race

The real story emerging this year is IREN’s push into AI compute infrastructure. This isn’t some small side project or a diversification experiment. It’s a full-scale expansion into one of the fastest-growing tech markets in the world.

The most important development?

IREN struck a $9.7 billion, five-year deal with Microsoft.

Under this agreement, IREN is building a 200MW liquid-cooled GPU data center in Childress, Texas – custom-designed to support Microsoft’s AI workloads. This is not a “regular” data center. This is high-density, liquid-cooled, next-generation infrastructure designed for training and running massive AI models.

Microsoft even paid 20% of the contract upfront – around $1.94 billion – giving IREN immediate capital to accelerate construction and hardware deployment.

This deal alone pushes IREN into a completely different tier of infrastructure providers. When a company at Microsoft’s scale trusts you with billions of dollars of AI compute capacity, it signals something important: you’ve arrived.

But Microsoft isn’t the only one knocking

Throughout the year, IREN also signed long-term compute commitments with Together AI, Fluidstack, and Fireworks AI. These groups are building and scaling their own AI platforms, and they’ve chosen IREN as one of the key partners supplying their GPU horsepower.

Individually, these contracts may not be as massive as Microsoft’s, but collectively they represent something meaningful – early validation from the AI ecosystem. These companies need reliable compute, predictable pricing, and fast deployment. IREN is giving them all three.

With these deals in play, IREN expects to hit $500 million in annual recurring AI compute revenue by early 2026, and if the build-outs stay on schedule, annual revenue from AI compute could surpass $3.4 billion by late 2026.

This would turn IREN into one of the biggest AI infrastructure providers in North America – and the company is making the investments to support that scale.

Turning Mining Campuses Into AI Supercenters

One thing that makes IREN fundamentally different from most new AI compute startups is this: it already controls the two most expensive building blocks of AI infrastructure – power and land.

The company has more than 2.9 gigawatts of available power across multiple sites and more than 2,000 acres of build-ready land. This means IREN doesn’t have to spend years fighting for grid approvals or zoning permissions. It can simply build.

In British Columbia, IREN is converting 160MW of former mining space into AI-focused GPU halls. This site alone is expected to house more than 60,000 GPUs once fully upgraded.

In Childress, Texas, the company is constructing the massive “Horizon” campus – a state-of-the-art, 200MW AI compute facility that will deliver Microsoft’s contracted capacity. The design supports extremely high rack density, advanced cooling, and specialized electrical infrastructure.

Then there’s Sweetwater, Texas, an even larger project: a planned 2,000MW data center campus. This site is in early development but represents IREN’s long-term vision: one of the largest hyperscale AI compute hubs in North America.

What gives IREN an edge is speed. Because it already owns the energy and the land, it can deploy AI capacity much faster than typical data center operators, who often spend years trying to secure power access alone.

A Dual-Engine Strategy With Serious Momentum

The most compelling part of IREN’s entire strategy is how naturally its two core businesses – Bitcoin mining and AI compute – support each other.

Mining is a high-margin, cash-generating machine. AI compute is a long-term, contract-driven business with predictable recurring revenue. Mining makes IREN fast. AI makes IREN stable.

Together, they form a model that very few infrastructure companies can match.

Bitcoin mining provides the liquidity needed to fund data center builds, while the long-term nature of enterprise AI contracts helps smooth out Bitcoin’s volatility. Energy expertise from mining translates perfectly into managing GPU clusters. And power contracts originally secured for mining operations now fuel massive AI deployments.

This isn’t a company with “two different businesses.”

This is one unified infrastructure strategy with two powerful engines.

So, What’s Next for IREN?

Looking ahead, IREN is in a stronger position than at any point in its history. The company has:

- $1.8 billion in cash reserves

- One of the most efficient mining fleets in the world

- Multi-billion-dollar AI compute contracts already signed

- A massive power and land footprint ready to expand

- Aggressive timelines to deploy tens of thousands of new GPUs

If execution stays strong, IREN could soon be recognized as one of the foundational companies supporting the next decade of AI growth.

And that’s what makes Q1 FY2026 so important. It wasn’t just a strong quarter – it was the first clear sign that IREN’s long-term strategy is working exactly the way it’s supposed to.

Conclusion

IREN’s record-setting Q1 wasn’t just about numbers. It was about direction. The company proved that it can operate one of the most efficient Bitcoin mining businesses in the world and simultaneously build out some of the most high-density AI compute centers in North America.

With Microsoft at its side, a growing list of AI clients, massive GPU deployments underway, and one of the largest power footprints in the sector, IREN is stepping into a future where it won’t just be known as a miner – it will be known as a critical backbone for the AI era.

Q1 FY2026 was a breakout moment, but it feels like the beginning of something much bigger.

Peter Davis is an accomplished blockchain analyst and technical writer with over four years of experience in the cryptocurrency sector. His expertise spans blockchain infrastructure, ASIC mining hardware, and digital asset markets, where he is recognized for translating complex technical concepts into precise, insightful, and accessible analysis for a global audience.

With a strong foundation in technical research and market evaluation, Peter’s work focuses on bridging blockchain innovation with practical mining and investment strategies. His writing is defined by analytical depth, clarity, and a focus on data-backed insights that guide both professionals and enthusiasts through the evolving crypto landscape.

Driven by a deep passion for Web3 technology and decentralized systems, Peter continues to produce authoritative, research-driven content that enhances understanding of ASIC mining performance, blockchain efficiency, and the broader dynamics shaping the future of digital finance