Resumen rápido

Cryptocurrency mining has changed and improved a lot through time. A very important gadget for miners nowadays is the ASIC (Application, Specific Integrated Circuit) miner. These machines are made for mining only and thus, they can give you good hashrate and low power consumption efficiently. If you want to buy ASIC miners, then it is very important first to understand their main features such as hashrate, power consumption, and return on investment (ROI). This article will tell you about these necessary factors and at the same time will give you some handy ideas on how to get the most out of your mining.

What is Hashrate in Mining?

Tasa de hash is without a doubt one of the more important concepts in cryptocurrency mining. It’s a way of describing the mining capabilities of a piece of hardware, and is typically measured in hashes per second (h/s). Hashing is a mathematical puzzle that allows cryptocurrency miners to unlock algorithms and authenticate these transactions on the blockchain.

The higher the hashrate, the more hashes a miner can perform in a second and so there are better odds that they will unlock the algorithm and be rewarded for mining.

Key Points to Understand:

- What is hashrate: Hashrate typically serves as an indicator of how competitive a miner is in the network. It measures the speed with which a miner is able to solve blocks, and thus receive mining rewards.

- Importance: The higher the hashrate, the higher chance you will have of earning mining rewards, the faster blocks are solved and the more secure the blockchain network as it becomes much more difficult for bad actors to attack.

- Hashrate Units: Hashrate is calculated in different units based on the power of the miner.

The most common units are:

- Kilohash (KH/s): Thousands of hashes per second.

- Megahash (MH/s): Millions of hashes per second.

- Gigahash (GH/s): Billions of hashes per second.

- Terahash (TH/s): Trillions of hashes per second.

How Much Power Does an ASIC Miner Use?

Power consumption is also a key consideration for ASIC miners. Mining is a very power-hungry activity that relies on underpowered computers to solve cryptographic challenges and help add information to the blockchain. The more powerful the miner is (the higher hashrate) – the more electricity it consumes.

Power Consumption Guide:

- Watts: Power consumption is commonly expressed in the watts (W) or Kilowatts (kW). The more watts you have that are used, the more electricity the miner uses. Consumption of power is a regular cost that miners need to manage if they wish to make money.

- Eficiencia: Powerful efficient ASIC miners consume less electricity in computation per unit (hash). A highly efficient mining machine uses less power, while producing a high hashrate making it more efficient as time passes. Efficiency is the key to the maximum return on investment.

Example of Power Consumption:

| Miner Model | Hashrate (TH/s) | Power Consumption (W) | Efficiency (J/TH) |

| Antminer S19 Pro | 110 TH/s | 3250 W | 29.5 J/TH |

| MicroBT WhatsMiner M30S+ | 100 TH/s | 3400 W | 34.0 J/TH |

| Bitmain Antminer L7 | 9.05 TH/s | 3425 W | 374.5 J/TH |

How to Calculate Mining ROI

How do you calculate Mining ROI? The mining ROI (Return on investment) is a measurement which shows

the speed at which you’ll be able to recover the cash that you spent on your ASIC mining equipment. It is a vital calculation for miners since it helps make the decision to invest much easier.

Fórmula de retorno de la inversión:

ROI= Net Profit/Initial Investment x 100

Where:

- Net Profit: The mining income after subtracting the electricity cost. The amount is Bitcoin or other cryptocurrency you’ve made, less the cost of energy and maintenance.

- First Investment : This is the price for an ASIC miner, which includes shipping as well as setup and other costs related to it.

Factors Affecting ROI:

- Electricity Cost: Increasing prices for electricity can significantly decrease the profitability of your business. It is essential to consider local prices for electricity in calculating ROI.

- Mining Difficulties: Network difficulty directly affects your income. When more miners sign up to the network the level of difficulty increases and it becomes more difficult to get rewards.

- Efficiency and Hashrate: The most powerful and efficient miners will provide greater ROI as they produce more hashes per unit of electricity.

Example ROI Calculation:

In the event that your ASIC miner is priced at $3000 and earns an average of $15 per day from mining profits While your electricity costs $5 per day the net daily profit will be $10. The ROI of your business can be calculated by:

ROI =(10USD/day x 365days)/ 3000USD =12.17%

This means it could take around 8.2 years to repay the initial investment. The most profitable return on investment in mining usually ranges from one to two years.

What is Joules Per Terahash (J/TH)?

Joules Per Terahash (J/TH) is a kind of measure that demonstrates how efficient an ASIC mining machine utilizes electricity to calculate the hash. The smaller the amount of J/TH is, the greater the machine’s efficiency.

Why J/TH Matters:

- Efficiency Metric: The J/TH number is directly related to the efficiency of the miner’s energy. Mining companies with lower J/TH are able to use less electricity to do the equivalent volume of jobs. This means lower electric bills and better profits.

- Energy Costs: higher J/TH ratio can result in greater energy expenses, which reduces your overall profit. Mining businesses need to give machines with lower J/TH numbers priority as the sector evolves toward more efficient technology.

Ejemplo:

- Antminer S19 Pro: 29.5 J/TH

- WhatsMiner M30S+: 30.0 J/TH

How to Interpret J/TH:

The Antminer S19 Pro is able to process one terahash at 29.5 Joules, which is more efficient than mining equipment with a J/TH of around 40. Efficiency is a major aspect in the overall profit of mining.

How Electricity Cost Affects Mining Profitability

The price of electricity is an important element in the mining’s profit. Miners usually spend more money on electricity than with any other operational expense. If the price to power your area is prohibitive, it could impact your profit margins.

Electricity Cost Per Kilowatt:

- Global Average: This average electric bill is about $0.10 per kWh, however it can vary between $0.03 up to $0.15 per kWh based on the region you’re located. This can have a major impact on the mining profit.

- Cost impact: A miner who has a high consumption of electricity will quickly decrease your profit when electricity costs are high. An electricity area that is low-cost can have a significant impact to your mining operations, possibly doubling or tripling your return on investment.

Practical Example:

| Miner Model | Power Consumption (W) | The price of electricity (per kWh) | Daily Power Cost (USD) |

| Antminer S19 Pro | 3250 W | $0.10 | $7.80 |

| WhatsMiner M30S+ | 3344 W | $0.10 | $8.00 |

Hashrate vs Power Consumption

Understanding the connection between power consumption and hashrate are vital to increase the efficiency of mining. These two factors are significant in determining the amount you make by mining crypto. Machines with high hashrates are able to process more data every second, and therefore are able to tackle more challenging problems and receive greater rewards from that. But, they also result in high power consumption, which is a major disadvantage in terms of profitability.

The challenge is High Hashrate or Power Consumption

Most miners are looking to get the highest level of trade off between high hashrates and the lowest power use. Higher hashrates need more power, but choosing the miner that provides the best combination of both can dramatically affect your mining profits overall.

High Hashrate

- What it means: The mining process could run more computations in seconds if the hashrate increases. This increases the chance of solving cryptographic problems which increases the chances of earning mining-related rewards for example, Bitcoin, Ethereum, or other cryptocurrency.

- Why it’s Important: The higher the hashrate is, the greater number of computations your miners can finish which in turn increases the amount of blocks you are able to make available to other network members, and consequently, the greater rewards you’ll receive. Mining who have high hashrates is an essential asset for those who compete.

But there’s a caveat that is that achieving a high hashrate will require more computational power, which results in a higher energy consumption. In the event that you’re running an ASIC mining device with a high hashrate, you have to recognize that it’s likely to consume lots of energy.

Low Power Consumption

- What does it mean: It is a measure of the volume energy your mining device uses to attain a particular hashrate. The more efficient your mining device is, and the less energy it needs to run the same amount of hashes.

- What’s the reason: Miners that use less electricity will enable you to keep your operating costs at a minimum while maintaining an efficient production level. This is the reason why miners with higher power efficiency and better Joules Per Terahash (J/TH) are important.

A low-power consumption mining device makes use of less power so you can use it for longer durations without raising your energy costs. If you select a mining device that has a low power consumption you will be able to keep costs under control but still increase your odds to mine coins.

Mining Profitability Calculation

Because electricity is among the largest and most ongoing costs for miners, it is crucial to select an efficient, powerful ASIC miner. Most efficient miners with respect to electricity are those which provide the highest hash rate with the least amount of electricity, and they offer you a greater profit margin over the course of time.

Key Factors to Consider for Profitability:

- Tasa de hash: The greater your mining hashrate, the higher your chances to efficiently mining a block and receive the rewards. But, it usually results in higher power use.

- Network Difficulty: Depending on how many miners are involved in the network, it varies dynamically. The degree of difficulty rises as more miners join this network, which may have an effect on your mining earnings.

- Block Reward: Amount of Recompensa por bloque you get when you successfully mine the block. In the case of Bitcoin this reward will be cut by half every 4 months (the “halving“), and the current Block reward is 3.125 BTC.

- Costos de electricidad: Because mining uses a lot of energy, your electricity costs can be a major expense. The more power you use and the rate of electricity in your area less profitable.

- Hardware Decreasing: ASIC mining equipment can degrade in efficiency with time. Older computers become less competitive in terms of the hashrate they can run and their power consumption when more potent and effective miners are launched, which lowers earnings.

How to Calculate Mining Profitability:

To determine profitability, take these steps to calculate profitability:

- Estimate your Daily Earnings: Multiply your mining hashrate by the difficulty of the network and block reward to determine the amount you’ll earn each day.

- Account for Electricity Costs: Calculate your energy use (in units of kW) by the local electricity cost (per Kilowatt hour) and the amount of time you intend to mine each day. Add this to your earnings to take into account the power cost.

- Factor in Other Costs: This could include maintenance for your hardware mining pool charges or cooling expenses, as well as other expenses.

- Utilize Profitability Calculators: Many websites offer mining profitability calculators that you can input the specifications of your miner including electricity rate, the number of hours, and other information to obtain an accurate estimate of your daily as well as monthly and annual profits.

Practical Example:

If you’re mining Bitcoin with an Antminer S19 Pro, which is hashing at 110 TH/s and consumes 3,250 Watts. The current Bitcoin block reward is 3.125 BTC, and the network difficulty is 25 trillion.

- Estimated Daily Earnings:

- Bitcoin block reward: 3.125 BTC per block.

- Network problem 25 trillion.

- Utilizing an online mining profitability calculator, we calculate earnings in the range of $13 per day.

- Electricity Cost:

- The power consumption is 3.25 kW.

- Cost of electricity: $0.10 per kWh.

- Daily electricity costs: 3.25 kW x $0.10/kWh * 24/7 equals $7.80 for a day.

- Net Profit:

- Earnings per day: $15.

- Costs of electricity minus $7.80.

- Net profit per day: $7.20.

Fórmula de retorno de la inversión:

Let’s say that the Antminer S19 Pro costs $3,000 Your net income is $7.20 per day.

ROI =(7.20USD/day x 365days) / 3000USD =8.73%

This means that it will require around 11.5 years to reach a point where you are making money for your initial investment which is a long time. In the real world, miners generally strive for a quicker return on investment, which is the reason selecting an efficient and powerful mining equipment is crucial.

Best Power Efficient ASIC Miner

Because electricity is among the most expensive and ongoing expenses for miners, it’s essential to select an efficient, powerful ASIC miner. Power miners that are efficient when it comes to electricity are those which provide the highest hash rate and use the least amount of power, so they can provide you with greater profit margin in the long run. We will review a few of the top power efficient ASIC miners currently being offered.

What Makes an ASIC Miner Power Efficient?

- Low J/TH Value: The Joules per Terahash (J/TH) value will tell you the amount of energy a miner needs to calculate one Terahash. The lower the number the more efficient mining energy.

- High Hashrate: Miners that have higher hashrates generally use more power. However, miners with the highest energy efficiency are able to keep low hashrates in balance with high energy consumption.

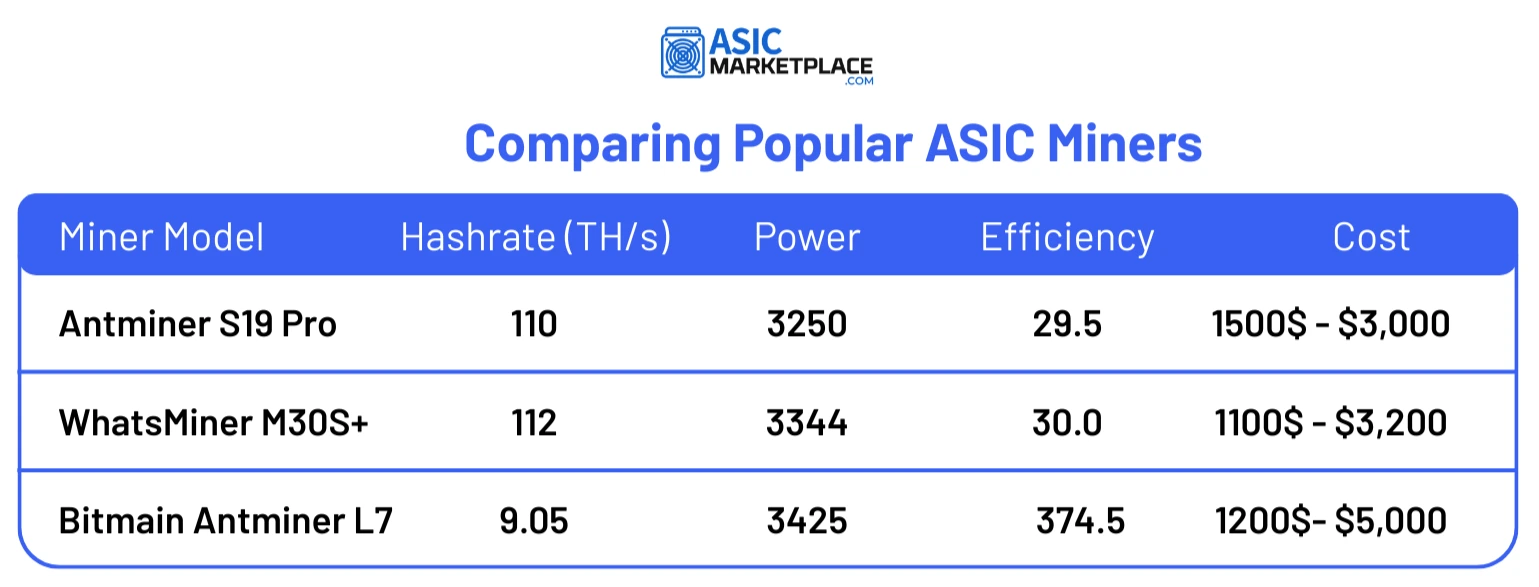

Comparing Popular ASIC Miners:

| Miner Model | Hashrate (TH/s) | Power Consumption (W) | Efficiency (J/TH) | Cost (USD) |

| Antminer S19 Pro | 110 | 3250 | 29.5 | 1500$ – $3,000 |

| WhatsMiner M30S+ | 112 | 3344 | 30.0 | 1100$ – $3,200 |

| Bitmain Antminer L7 | 9.05 | 3425 | 374.5 | 1200$- $5,000 |

Why Antminer S19 Pro:

- Eficacia: Antminer S19 Pro Antminer S19 Pro has an effectiveness of 29.5 J/TH. It is one of the most effective miners available today. Even though its hash speed is 110 TH/s, it only requires 3250 watts, which permits miners to boost their earnings.

- Power vs. Performance: With its optimal efficiency Antminer S19 Pro is optimized for efficiency. Antminer S19 Pro provides a good balance between computing performance and energy consumption. providing the lowest electricity cost to earn the most money.

Emerging Alternatives:

- Miner M30S+ is a more recent model with the same effectiveness (30.0 J/TH) but with slightly higher power consumption, however a slightly more hashrate, at 112 TH/s.

- Bitmain Antminer L7 Designed to be used for both Litecoin as well as Doge mining. It has high hashrate and performance, however at a price that is higher which is important for profit.

Factors to Consider:

- Tasa de hash: The greater the power of the miner, the more power it consumes. The ability to find the right balance between hashrate and the power consumption is crucial.

- Costos de electricidad: Even the most efficient miners might not make a profit in areas that have high electricity costs. Be aware of local rates prior to investing in a project.

Decreasing: ASIC miners lose efficiency with time, and modern models tend to outperform the older models in terms of power consumption and hashrate.

Conclusión

Mining with ASIC miners is not a simple process. You have to take into account the hashrate, power consumption, and ROI, among other things. Choosing the right ASIC miner can have a huge effect on your profits because it will determine how much you spend on running the operations and how much you will potentially earn. If you include the price of electricity, the level of difficulty of mining, and the efficiency of the equipment in your considerations, you will be able to make better choices.

If you need a trustworthy platform to buy high quality ASIC miners that fit your requirements perfectly, look no further than ASIC Marketplace and similar platforms providing an extensive range of options that will ensure you get the ideal miner for your setup. Starting your mining journey or upgrading to newer mining hardware, a good grasp of the main features such as hashing power and energy consumption will guarantee that you do not waste your money.

It is a wise decision to buy energy, efficient miners and measure return on investment accurately to increase your mining earnings. Wishing you successful mining adventures!

Preguntas frecuentes

-

How much is the hash-rate of an excellent ASIC miner?

A high-quality ASIC mining machine typically is able to achieve a hash ratio between 90 TH/s to 150+ TH/s, based on the mining algorithm. Higher hash rates increase your odds of earning regular mining rewards.

-

What is the price of 1 hash price?

1 hash rate is one cryptographic computation per second. In real life, miners operate in larger quantities than the TH/s (trillions of hashes per second).

-

How long will it take to earn a profit using ASIC?

ASIC mining ROI is typically between 12 and 24 months, based on the costs of electricity, the miner’s effectiveness, network difficulty and cryptocurrency prices.

-

How many kWh is needed to make 1 bitcoin?

On average, it requires 130,000-150,000 kWh of energy to mine one Bitcoin, however this can vary according to the efficiency of the miners and the network’s difficulty.

Peter Davis es un consumado analista de blockchain y redactor técnico con más de cuatro años de experiencia en el sector de las criptomonedas. Su experiencia abarca la infraestructura blockchain, el hardware de minería ASIC y los mercados de activos digitales, donde es reconocido por traducir conceptos técnicos complejos en análisis precisos, perspicaces y accesibles para una audiencia global.

Con una sólida base en investigación técnica y evaluación de mercados, el trabajo de Peter se centra en vincular la innovación de blockchain con estrategias prácticas de minería e inversión. Sus escritos se caracterizan por la profundidad analítica, la claridad y el enfoque en las perspectivas respaldadas por datos que guían tanto a profesionales como a entusiastas a través del cambiante panorama de las criptomonedas.

Impulsado por una profunda pasión por la tecnología Web3 y los sistemas descentralizados, Peter sigue produciendo contenidos de autoridad, basados en la investigación, que mejoran la comprensión del rendimiento de la minería ASIC, la eficiencia de blockchain y la dinámica más amplia que da forma al futuro de las finanzas digitales.